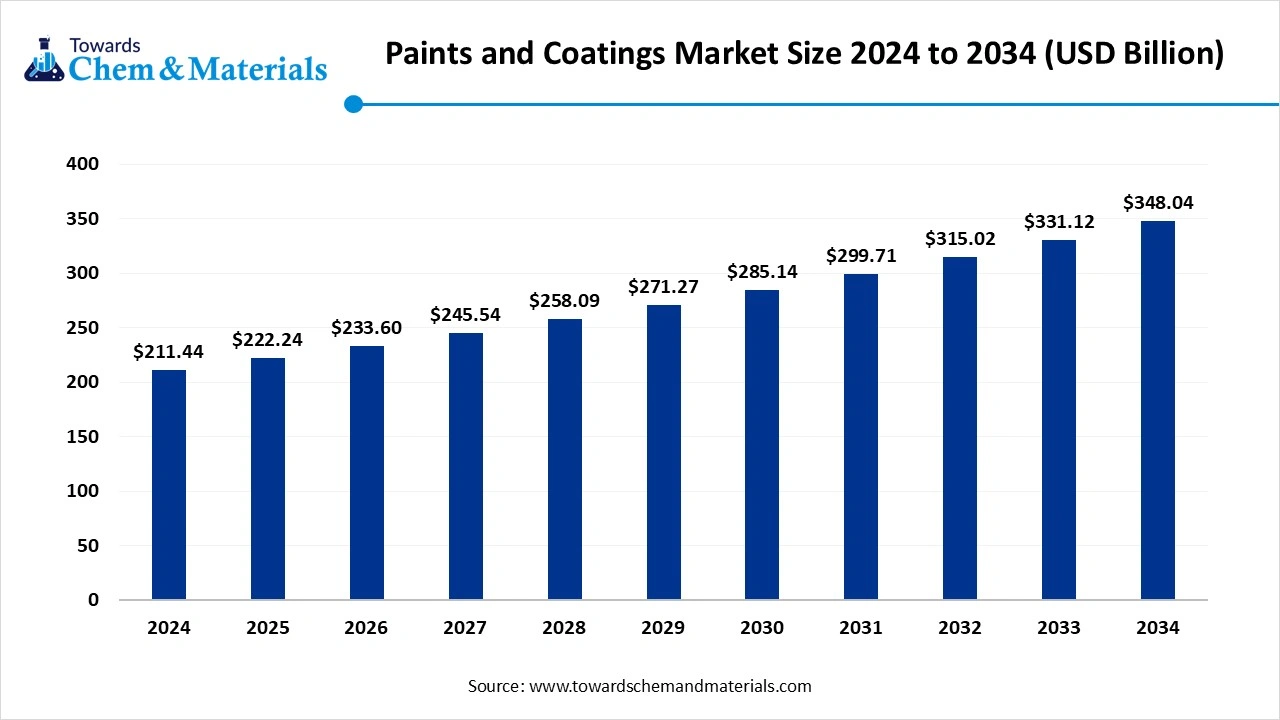

Paints and Coatings Market Size to Surpass USD 348.04 Bn by 2034

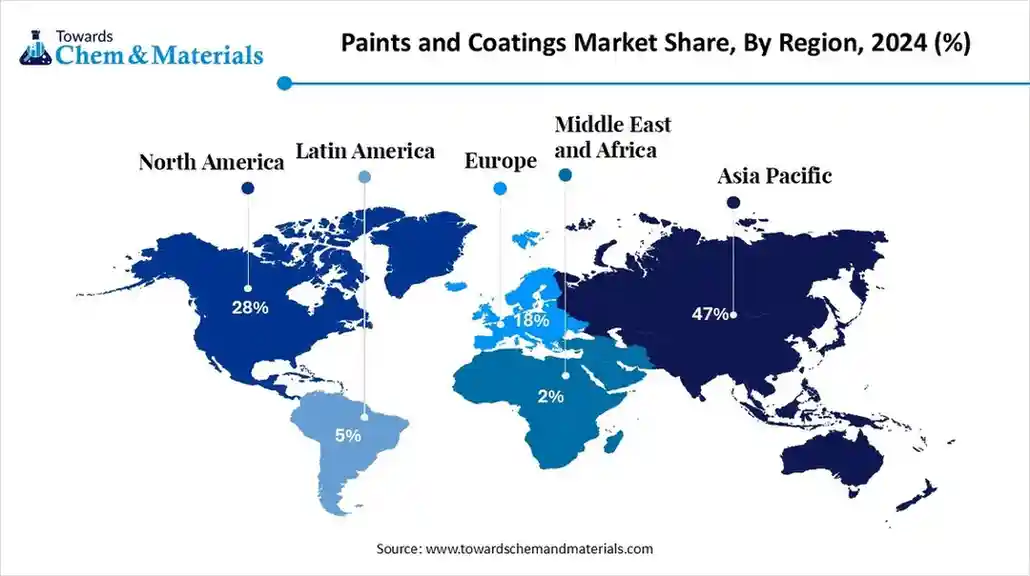

According to Towards Chemical and Materials, the global paints and coatings market size is calculated at USD 222.24 billion in 2025 and is expected to surpass around USD 348.04 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.11% over the forecast period 2025 to 2034. The Asia Pacific dominated the Paints and Coatings market with a market share of 47% in 2024.

Ottawa, Oct. 22, 2025 (GLOBE NEWSWIRE) -- The global paints and coatings market size was accounted for USD 211.44 billion in 2024 and is anticipated to hit around USD 348.04 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.11% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5933

Paints And Coatings Overview

The global paints and coatings market encompasses the production liquid, powder, or semi liquid coatings that provide decoration, protection and functional enhancements to a wide array of surfaces across industries such as construction, automotive, industrial and consumer goods.it is being driven by a combination rising urbanisation and infrastructure investment, expanding automotive production and industrial output, and a growing preference for eco-friendly. Low VOC, waterborne and advanced high performance coating technologies. Technological innovation is reshaping the space through development of smart coatings such as self-healing, antimicrobial and colour changing systems and manufacturers are scaling up in regions with rapid industrial and construction growth to meet burgeoning demand.

Paints and Coatings Market Report Highlights

- By region, Asia Pacific dominated the market with a share of approximately 47% in 2024.

- By resin type, the acrylic segment dominated the market with a share of approximately 47.5% in 2024.

- By technology, the water-based segment dominated the market with a share of approximately 41.3% in 2024.

- By application, the architectural coatings segment dominated the market with a share of approximately 48.97% in

- By application, the automotive coatings segment is expected to grow in the forecast period.

- By end-use industry, the construction segment dominated the market with a share of approximately 50% in 2024.

What are Paint and Coatings Made Out of?

A paint or coating is a mixture of components:

- a carrier (water or solvent or both) that will evaporate during the drying of the coating, although there are also some coatings that are ‘100%’

- a binder (a polymer, examples are alkyds, polyurethanes, oils, natural or synthetic) that is the film-forming component in the coating,

- other components that are often but not always present:

- pigments or dyes that add color

- hiding pigments to make the coating non-transparent (so that the surface or color underneath is not visible anymore)

- fillers, which are added to give extra volume or extra solids to the coating

- flow agents, anti-foam agents, anti-settling agents, UV-stabilizers, and biocides, which are added in small amounts to improve certain properties

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5933

Paints And Coatings Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 233.60 billion |

| Revenue forecast in 2034 | USD 348.04 billion |

| Growth rate | CAGR of 5.11% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2020 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Resin Type, By Technology, By Application, By End-Use Industry, By Region |

| Key companies profiled | Jotun; The Sherwin-Williams Company; Axalta Coating Systems; PPG Industries, Inc.; RPM INTERNATIONAL, INC.; BASF SE; Henkel AG & Company, KGaA; Contego International Inc.; Hempel A/S; No-Burn Inc.; Nullifire; 3M; Albi Protective Coatings; Akzo Nobel N.V. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Paints And Coatings Market Concentration & Characteristics

The paints and coatings market is moderately fragmented, with players that aim to achieve optimum business growth and strong market positioning through production capacity expansions, new product development, acquisitions, collaborations, partnerships, and investments in research & development. Manufacturers have anticipated a huge gap in product and product development; thus, they are investing in research & development to add new products to their portfolios and develop better technologies for various end use industries of the product.

PPG Industries, Inc.; The Sherwin-Williams Company; Axalta Coating Systems, LLC; and Akzo Nobel N.V. are among the top manufacturers in the product market. These companies have a stronghold in the emerging markets of Asia Pacific and the Middle East & Africa while exporting their products for various end use applications, such as architectural & decorative and protective & marine applications in these regions.

Here Are Some Of The Top Products In The Paints And Coatings Market

- Architectural Paints: Used for interior and exterior surfaces in residential and commercial buildings; includes emulsions, primers, and enamels.

- Automotive Coatings: Specialized paints for vehicles; includes basecoats, clearcoats, and electrocoats for protection and aesthetics.

- Industrial Coatings: Applied to machinery, equipment, and metal structures to resist corrosion, wear, and chemicals.

- Powder Coatings: Dry, solvent-free coatings used in appliances, automotive parts, and furniture; eco-friendly and durable.

- Wood Coatings: Protect and enhance wood surfaces; used in furniture, flooring, and cabinetry.

- Marine Coatings: Protect ships and offshore structures from corrosion, fouling, and harsh marine environments.

- Protective Coatings: High-performance coatings used in infrastructure (bridges, pipelines) for extreme durability.

- Aerospace Coatings: Lightweight and durable coatings for aircraft surfaces to resist high temperatures and environmental stress.

- Coil Coatings: Applied to metal coils (steel/aluminum) before fabrication; used in construction and appliances.

- Can Coatings: Specialized coatings for the inside of food and beverage cans to prevent corrosion and contamination.

What Are The Major Trends In The Paints And Coatings Market?

- A growing shift towards sustainability, with the industry transitioning from solvent based to low VOC, water based coatings to meet regulatory and environmental demands.

- Rapid adoption of advanced and smart coating technologies, including UV cured, Nano coatings and self-healing or antimicrobial finishes to enhance performance and functionality.

- Expansion of demand in emerging regions, driven by urbanisation, infrastructure and industrial growth, especially in Asia Pacific and other high growth market.

- Strategic industry consolidation and manufacturing capacity expansion as major players invest in research and development, acquisition and regional production to strengthen their portfolios and meet evolving application needs.

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5933

Paints and Coatings Market Dynamics

How Is Sustainability Reshaping The Paints And Coatings Landscape?

The industry is moving towards eco-friendly solutions with water based, powder, and bio based coatings gaining traction. Companies are focusing on reducing waste, cutting VOCs, and adopting renewable raw materials to meet regulatory and consumer demands. This shift is pushing innovation in sustainable products that balance performance with environmental responsibility.

How Is Digital Transforming Driving Growth?

Automation, AI and smart sensors are streamlining production and ensuring consistent quality in coatings manufacturing. Real time data tools help reduce waste, speed up formulation, and create tailed solutions for industries. The digital shift is giving manufacturers efficiency and competitive advantage in a fast chaining market.

Market Opportunity

What Opportunities Do Electric Vehicles Create For Coatings?

The rise of electric vehicles is driving demand for coatings that protect batteries, manage heat, and provide electrical insulation. These needs to go beyond traditional automotive paints, opening space for advanced, functional solutions. For the coatings industry, EVs create a chance to move into high performance applications.

How Are Smart Coatings Opening New Market?

Smart coatings that self-heal, resist microbes, or adapt to their environmental are gaining traction in sectors like healthcare, electronics, and infrastructure. By offering functionality as well as protection, they create high value opportunities. This trend allows manufacturers to deliver differentiated products for modern applications.

Limitations In The Paints And Coatings Market

- The market is constrained by stringent regulatory requirements on emissions, chemical usage and waste management, which increase compliance costs and complicate product development.

- Rising raw material vitality and supply chain disruptions hamper coatings manufacturers as fluctuating resin, pigment and additive costs squeeze margins and delay new product roll out.

Paints and Coatings Market Segmentation Insights

Resin Type Insights

Which Resin Type Dominates The Global Paints And Coatings Market?

The acrylic resin segment dominated the market in 2024, attributed to its exceptional versatility and widespread applicability across various industries. Acrylic based coatings are renowned for their superior durability, excellent colour retention, and resistance to environmental factors such as UV degradation and moisture, making them ideal for both decorative and protective applications. These properties have led to their extensive use in architectural, automotive, and industrial coatings, where performance and longevity are paramount. Furthermore, the growing emphasis on environmental sustainability has bolstered the demand for waterborne acrylic coatings, aligning with stringent VOC regulations and eco-friendly initiatives. This combination of acrylic resins in the market.

Epoxy resins are witnessing rapid growth in the market during the forecast period, driven by their exceptional adhesion, chemical resistance, and durability, making them suitable for a wide range of industrial applications. The expanding construction and infrastructure sectors are significant contributors to this growth, as epoxy coatings offer protective solutions for concrete surfaces, steel structures, and flooring systems, enhancing their longevity and performance. Additionally, the automotive and aerospace industries are increasingly adopting epoxy based coatings for their superior protective qualities and ability to withstand harsh environmental conditions. The versatility of epoxy resins, coupled with ingoing advancements in formulation technologies, positions them as a key growth driver in the market.

Technology Insights

Which Technology Is Dominating The Global Paints And Coatings Market?

Water based coatings have emerged as the dominant technology in the global market in 2024, primarily due to their environmental benefits and complicate with stringent regulatory standards. These coatings utilize water as a solvent, reducing the emission of volatile organic compounds (VOCs) and minimizing environmental impact. The increasing demand for sustainable and low emission products across various industries, including construction, automotive, and industrial manufacturing, has propelled the adoption of water based technologies.

UV-cured coatings are anticipated to experience the highest growth rate in the market during the forecast period, driven by their rapid curing process and energy efficiency. Utilizing ultraviolent light to initiate polymerization, UV cured coatings offer immediate handling and processing capabilities, reducing production time and energy consumption. This technology is particularly advantageous in high volume manufacturing settings, such as automotive and electronics industries, where speed and efficiency are critical.

Application Insights

Which Application Holds The Largest Global Paints And Coatings Market Share?

The architectural coatings segment commands the largest share of the global paints and coatings market in 2024, driven by the continuous demand for residential, commercial, and infrastructure development projects. Architectural coatings encompass a wide range of products, including interior and exterior paints, primers, and finishes, designed to enhance the aesthetic appeal and protect building surfaces. Factors such as urbanization, population growth, and increased disposable incomes contribute to the sustained demand for architectural costings.

The automotive coatings segment is experiencing rapid growth during the forecast period, fuelled by the expanding automotive industry and the increasing demand for high quality finishes. Advancements in coating technologies, such as the development of more durable, scratch resistant, and environmentally friendly formulations, are contributing to this growth. The rise in vehicle production, particularly in emerging markets, coupled with consumer preferences for aesthetically pleasing and long lasting finishes, is striving the demand for automotive coatings.

End Use Industry Insights

Which End Use Industry Dominates The Global Paints And Coatings Market?

The construction industry segment dominated the market in 2024, accounting for a substantial share due to the extensive application of coatings in both residential and commercial buildings. Coatings in the construction sector serve multiple purposes, including surface protection, aesthetic enhancement, and compliance with safety and environmental standards. The ongoing trends of urbanization, infrastructure development. And renovation projects contribute o the sustained demand for construction practices and energy efficient buildings has led to the development and adoption of specialized coatings that meet these criteria.

The automotive industry segment is projected to be the fastest growing in the paints and coatings market during the forecast period, driven by the surge in vehicle production and technological advancements in coatings applications. The demand for automotive coatings is propelled by factors such as the need for enhanced suability, corrosion resistance, and aesthetic appeal in vehicles. Innovations in coating technologies, including the development of lightweight and eco-friendly formulations, are further fuelling this growth.

Regional Insights

Which Region Dominates the Paints and Coatings Market?

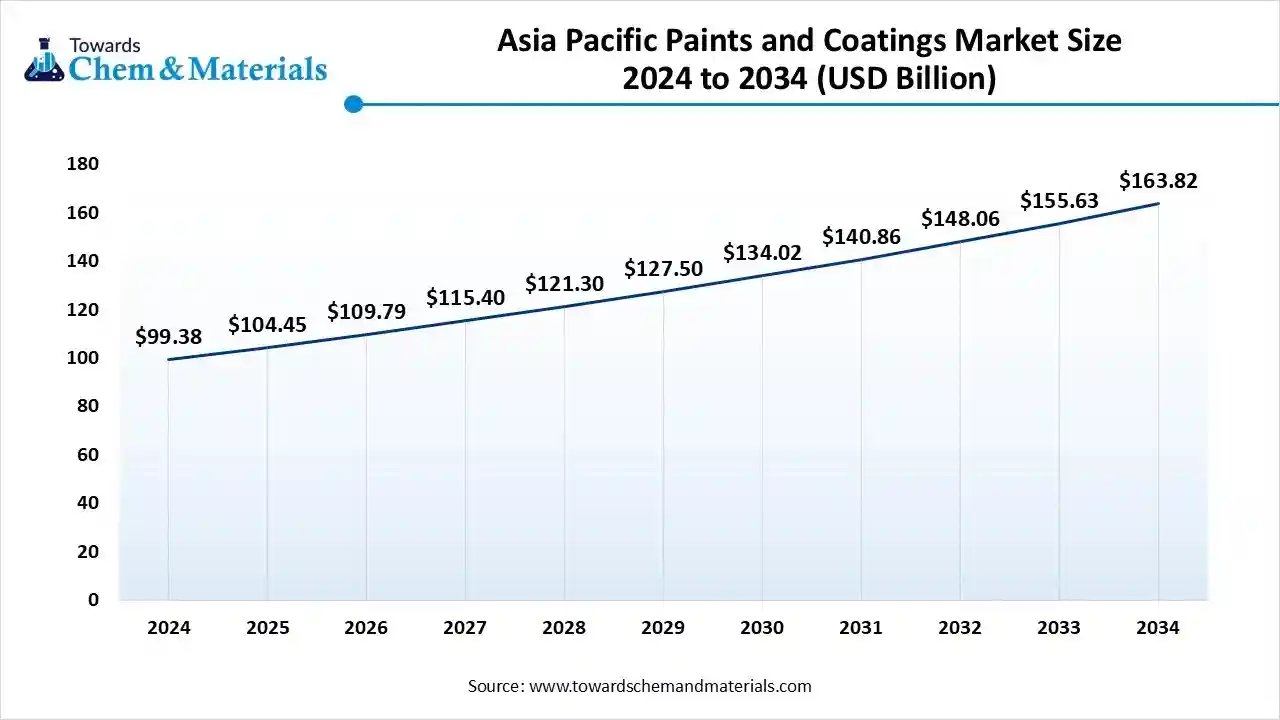

The Asia Pacific paints and coatings market size is estimated at USD 104.45 billion in 2025 and is projected to reach USD 348.04 billion by 2034, growing at a CAGR of 5.11% from 2025 to 2034.

Asia Pacific dominated the market with a share of approximately 47% in 2024, driven by rapid urbanization, industrialization, and increasing consumer demand across multiple sectors. Countries like China, India, and Japan are major contributions to this growth, thanks to robust manufacturing bases and expanding construction and automotive industries. The region’s dominance is further supported by a growing middle class and easing disposable incomes, fuelling demand for both decorative and functional coatings. Additionally, increasing environmental awareness and regulatory pressures are pushing industries toward low-VOC and eco-friendly coating solutions. This combination of factors positions Asia Pacific as the dominant force in the market.

India’s paints and coatings market is experiencing significant growth, driven by rapid urbanization and a booming housing sector. Government initiates like “Make in India” are encouraging domestic manufacturing and infrastructure development, further fuelling market expansion. The country’s increasing population and rising disposable incomes are boosting demand for both residential and commercial coatings. Additionally, India’s focus on sustainability and eco-friendly solutions is aligning with global trends, making it a pivotal player in the regional market.

Why Is North America Seeing Rapid Growth In Paints And Coatings?

North America has experienced notable growth in the market during the forecast period, supported by technological innovation, sustainability initiates, and strong automotive and aerospace sectors. The demand for high performance coatings with corrosion resistance, low emissions, and UV stability continues to rise. Stringent environmental regulations are also accelerating the shift toward waterborne and UV curved coating technologies. These trends highlight the region’s increasing adoption of advanced solutions to meet bth industrial and consumer needs.

The U.S. paints & coatings market size was reached at USD 32.19 billion in 2024 and is expected to be worth around USD 50.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.35% over the forecast period 2025 to 2034. The U.S. dominates North America’s paints and coatings market due to strong research and development investments and robust industrial activity. There is growing adoption of eco-friendly, low- VOC coatings in residential and commercial construction, while technological advancements in smart and self-healing coatings are shaping the premium segment. This combination of innovation and sustainability positions the U.S. as a key player in regional market growth.

Europe Paints And Coatings Market Trends

The global European paints & coatings market size is valued at approximately USD 39.99 billion in 2025 and is projected to climb to roughly USD 54.27 billion by 2034, translating into a compound annual growth rate (CAGR) of 3.45% across the period from 2025 to 2034

Europe’s paints and coatings market shows steady growth, driven by sustainability innovation, and regulatory compliance. Rising demand for advanced legislation. The recovery in construction and strong demand for automotive and industrial manufacturing sectors support consistent market performance.

The UK market emphasisers premium architectural coatings and automotive refinishing solutions, with green building standards and eco-label certifications influencing manufacturers to developed water based and bio based products. Renovation projects and electric vehicle production are driving demand for advanced, high-durability, and energy efficient coatings. These reinforce the UK’s leadership in sustainable and innovative coatings within Europe.

Latin America Paints And Coatings Market Trends

The paints & coatings market in Latin America is expected to witness substantial growth in the product demand over the forecast period, owing to the region’s economic growth in the past few years. Increasing disposable income of consumers has surged the demand for automobiles, which is expected to augment the demand for the product over the forecast period. Increasing automotive vehicle sales in Argentina, Brazil, and Colombia are also expected to have a positive impact on the market. Rising foreign investments in the automotive sector in the region are expected to open new growth avenues for paints & coatings over the forecast period.

The Brazil paints & coatings market is anticipated to grow from 2025 to 2034. Brazil is the leading producer of automobiles in Latin America and has emerged as the ninth-largest automobile producer in the world. According to the International Organization of Motor Vehicle Manufacturers, automotive production in Brazil witnessed an increase of 5.1% in 2022 compared to 2021.

Furthermore, in 2023, the Brazil automotive industry is projected to experience a 2.23% increase in automobile output, with approximately 2.62 million vehicles being manufactured. This growth is expected to be driven by a 4.3% rise in the production of cars and other light vehicles. As one of the fastest-growing economies, Brazil has become a global hub for manufacturers. Automotive manufacturers are focusing on increasing their customer base by entering new markets. Owing to the trends, the demand for paints & coatings is anticipated to rise in automotive applications over the forecast period.

Middle East & Africa Paints and Coatings Market Trends

The Middle East paints and coatings industry growth is likely to be driven by the expanding oil & gas industry and rising healthcare expenditure in the region. The Middle East oil & gas industry has been witnessing a major shift in recent years with rising investment in a diverse range of projects, including technical offshore and LNG projects. This trend is expected to continue in the coming years, as major players in the market are expanding their presence in the region and are engaged in long-term projects, such as Upper Zakum, a production capacity enhancement project in the UAE; Zubair Oil Field - Rehabilitation Phase and Enhanced Re-Development Phase in Iraq; and Yanbu, a crude oil-to-chemicals complex project in Saudi Arabia. This positive scenario of the oil & gas industry is expected to drive the demand for paints & coatings in the oil & gas industry over the forecast period.

Saudi Arabia paints & coatings market is projected to witness growth during the forecast period. The demand for paints & coatings in Saudi Arabia has been experiencing a significant rise, due to several factors. Firstly, the country's construction and architectural sector has witnessed substantial growth, driven by mega projects, such as the Red Sea Project and the Qiddiya entertainment city. These developments have increased the need for paints & coatings in various applications.

Paints And Coatings Market Top Companies

- Sherwin-Williams: Dominates architectural paints in North America; strong global distribution.

- PPG Industries: Leader in automotive, industrial, and aerospace coatings.

- AkzoNobel: Major supplier of decorative paints, especially in Europe and Asia.

- BASF SE: Innovator in OEM and industrial coatings with chemical integration.

- Axalta: Specializes in high-performance coatings for vehicles and industries.

- RPM International: Focuses on specialty coatings and consumer brands like Rust-Oleum.

- Nippon Paint: Strong presence in Asia-Pacific with decorative and automotive coatings.

- Kansai Paint: Key player in auto OEM coatings and African markets.

- Jotun: Leader in marine and protective coatings.

- Hempel: Supplies protective coatings for infrastructure, marine, and energy sectors.

More Insights in Towards Chemical and Materials:

- Powder Coatings Market : The global powder coatings market size was valued at USD 17.25 billion in 2024 and is estimated to hit around USD 30.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% during the forecast period 2025 to 2034.

- Green Coatings Market : The global green coatings market size was reached at USD 137.83 billion in 2024 and is estimated to surpass around USD 224.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.99% during the forecast period 2025 to 2034.

- Wood Coatings Market : The global wood coatings market size was valued at USD 12.09 billion in 2024 and is expected to reach around USD 20.36 billion by 2034, growing at a CAGR of 5.35% from 2025 to 2034.

- Nanocoatings Market : The global nanocoatings market size accounted for USD 16.93 billion in 2024 and is predicted to increase from USD 20.10 billion in 2025 to approximately USD 94.40 billion by 2034, expanding at a CAGR of 18.75% from 2025 to 2034.

- Pipe Coatings Market : The global pipe coatings market size was valued at USD 9.95 billion in 2024 and is growing to approximately USD 16.84 billion by 2034, with a developing compound annual growth rate (CAGR) of 5.40% over the forecast period 2025 to 2034.

- Flat Glass Coatings Market : The global concrete floor coatings market size was reached at USD 3.91 billion in 2024 and is estimated to reach around USD 14.75 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.20% during the forecast period 2025 to 2034.

- Concrete Floor Coatings Market : The global concrete floor coatings market size was valued at USD 5.07 billion in 2024 and is expected to reach around USD 8.53 billion by 2034, growing at a CAGR of 5.35% from 2025 to 2034.

- Functional Coatings Market : The global functional coatings market volume was reached at 7.95 million tons in 2024 and is expected to be worth around 13.14 million tons by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034.

-

Low-VOC Coatings Market ; The global low-VOC coatings market size was reached at USD 8.75 billion in 2024 and is expected to be worth around USD 15.16 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.65% over the forecast period 2025 to 2034.

-

Cement Paints Market ; The global cement paints market size was valued at USD 5.89 billion in 2024 and is estimated to reach around USD 8.11 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 3.25% during the forecast period 2025 to 2034.

- Self-Healing Coatings Market : The global self-healing coatings market size accounted for USD 3.21 billion in 2024 and is predicted to increase from USD 4.12 billion in 2025 to approximately USD 39.16 billion by 2034, expanding at a CAGR of 28.42% from 2025 to 2034.

-

Sustained Release Coatings Market : The global sustained release coatings market size was reached at USD 675.85 million in 2024 and is expected to be worth around USD 1,373.63 million by 2034, growing at a compound annual growth rate (CAGR) of 7.35% over the forecast period 2025 to 2034.

Paints and Coatings Market Top Key Companies:

- Jotun

- The Sherwin-Williams Company

- Axalta Coating Systems

- PPG Industries, Inc.

- RPM INTERNATIONAL, INC

- BASF SE

- Henkel AG & Company, KGaA

- Contego International Inc.

- Hempel A/S

- No-Burn Inc.

- Nullifire

- 3M

- Albi Protective Coatings

- Akzo Nobel N.V.

Recent Developments

- In October 2025, In a significant move, BASF has agreed to sell a majority stake in its coatings business to private equity firm Carlyle and the Qatar Investment Authority, valuing the unit at €7.7 billion. BASF will retain a 40% stake and receive approximately €5.8 billion in pre-tax cash upon completion. This transaction is part of BASF’s strategy to focus on businesses closely integrated within its major chemical plants globally.

- In October 2025, AkzoNobel, maker of Dulux paints, is selling non-core assets, including its Indian decorative paints unit to JSW Paints, to focus on key markets.

Paints and Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Paints and Coatings Market

By Resin Type

- Acrylic

- Waterborne Acrylic

- Solvent borne Acrylic

- Epoxy

- Bisphenol-A Epoxy

- Novolac Epoxy

- Alkyd

- Polyurethane (PU)

- Polyester

By Technology

- Water-Based

- Solvent-Based

- Powder Coating

- UV-Cured Coating

- High Solids Coating

By Application

- Architectural Coatings

- Interior Wall Coatings

- Exterior Wall Coatings

- Industrial Coatings

- Automotive Coatings

- OEM Coatings

- Refinish Coatings

- Protective Coatings

By End-Use Industry

- Construction

- Automotive

- Industrial Equipment

- Consumer Goods

- Electronics

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5933

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.