Polyamide Market Volume to Worth 12.90 Million Tons by 2034

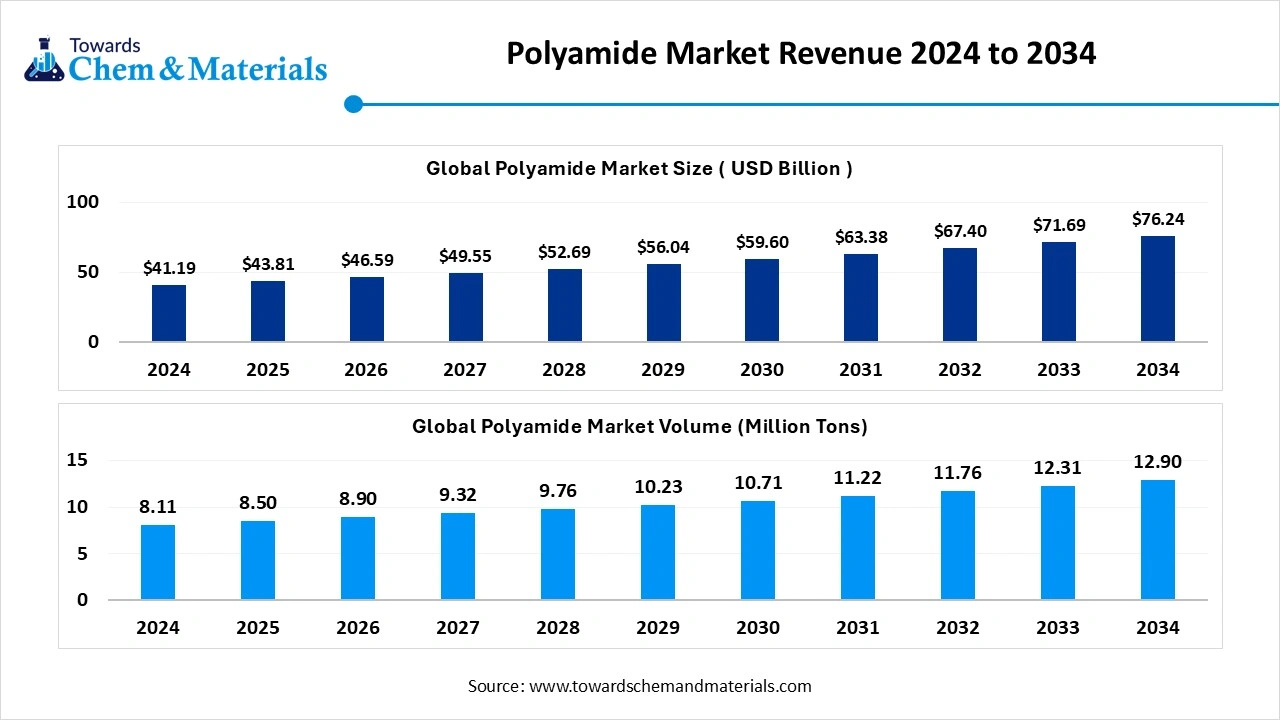

According to Towards Chemical and Materials, the global polyamide market stands at 8.50 million tons in 2025 and is forecast to reach 12.90 million tons by 2034, advancing at a 4.75% CAGR. The Asia Pacific dominated the Polyamide market with a market share of 44.85% in 2024.

Ottawa, Oct. 22, 2025 (GLOBE NEWSWIRE) -- The global polyamide market valuation is estimated to reach USD 43.81 billion in 2025 and is anticipated to grow to USD 76.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.35% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The global polyamide market is experiencing rapid growth, with volumes expected to increase from 8.50 million tons in 2026 to 12.90 million tons by 2034, representing a robust CAGR of 4.75% over the forecast period. Rising demand for lightweight and durable materials in the automotive and electronics industries is driving market growth.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5637

Polyamide Overview

The global polyamide market is experiencing robust growth, driven by increasing demand across various industries such as automotive, electronics, electrical, and textiles, Polyamides, particularly polyamide 6 and polyamide 66, are favoured for their exceptional mechanical properties, thermal stability, and chemical resistance, making them ideal for applications requiring durability and performance. In the automotive sectors, polyamides are increasingly utilized to replace metal components, contributing to weight reduction and improved fuel efficacy. The electronics industry also benefits from polyamides insulating properties, enhancing the performance and longevity of electronic devices.

Polyamide Market Report Highlights

- Asia Pacific polyamide market dominated and accounted for the largest revenue share of over 44.85% in 2024.

- By product, the polyamide 6 product segment recorded the largest market revenue share of over 52.85% in 2024.

- By product, the Bio-based polyamide is projected to grow at the fastest CAGR of 11.2% during the forecast period.

- By application, the engineering plastics segment recorded the largest market share of over 58.11% in 2024.

- By application, the fibers segment is anticipated to experience the highest CAGR of 4.75% during the forecast period.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5637

What Are Examples of Polyamide?

Polyamides are a large group of materials with different molecular structures and mechanical, electrical, and thermal properties. In addition, there are many different ways in which the material can be processed, i.e. woven into fabric, cast, extruded, or even injection molded. Listed below are some general examples of polyamides:

- Kevlar: An aramid fiber with excellent tensile strength and thermal resistance. It is used as a reinforcing material for tires and in bulletproof vests.

- Zytel: A semi-aromatic polyamide with excellent thermal and tensile strength as well as excellent resistance to moisture and chemicals. Zytel® is often used in the manufacture of firearms.

-

Nylon: Nylon is an aliphatic polyamide available in many different grades that cover a wide range of applications from fabric to complex injection molded parts.

Polyamide Market in Recent Developments

- In February 2025, INVISTA inaugurated Texas Technology Center (TTC), a USD 13 million technology hub and research and development center in the Houston metro area. The nearly 40,000-square-foot facility located in Katy, Texas, which INVISTA first announced in August of last year, will have more than 50 members of R&D, Engineering and Advanced Process Control teams supporting INVISTA’s global technology needs in the chemical intermediates and polymer product lines for both the Nylon and Propylene businesses, as well as data scientists and members of INVISTA’s EHS, transformation and project teams.

- In October 2024, Envalior launched new Tepex high-performance composites with matrices made from polyetherimide (PEI), polyphenylene sulfide (PPS), and polyamide 4.6 and 4.10 (PA4.6 and PA4.10). These materials provide excellent heat resistance, mechanical strength, and sustainability, making them ideal for aerospace, automotive, rail, and sports applications.

- In May 2024, Envalior announced that it supported the Dutch-based manufacturer Ahrend in delivering Remode, a sustainable office chair. The chair’s structural seat components, backrest mechanism, and star base are made from Akulon RePurposed, a versatile, high-performance polyamide produced from recycled fishing nets

- In April 2024, DOMO Chemicals, a prominent global player in the engineering materials sector specializing in polyamides, inaugurated a new USD 14.7 million production plant for TECHNYL polyamides in Haiyan, Jiaxing, Zhejiang, China. This facility, which covers an area of 40,000 square meters, is designed to enhance the company’s production capacity from 25,000 tons to 35,000 tons initially, with a long-term goal of reaching 50,000 tons.

- In January 2024, BASF and Inditex significantly advanced textile recycling by introducing Loopamid, the first circular nylon 6 entirely derived from textile waste. This innovative solution addresses the growing need for sustainability in the fashion industry by enabling the recycling of polyamide 6 (PA6) materials, commonly known as nylon .

What Are Polyamides?

Polyamides are synthetic or natural polymers. They are made up of amide groups that are repeated and interconnected by amide links. They have increased crystallinity, and thermal and chemical resistance due to the presence of hydrogen bonds. Polyamides generally have poor resistance to moisture absorption, but, on the upside, some have excellent tensile strength and impact resistance. Some examples of natural polyamides include wool, silk, collagen, and keratin. Synthetic polyamides can be broken down into three categories:

- Aliphatic Polyamides: This category also includes many grades of nylon such as Nylon 6 and Nylon 6/6.

- Aromatic Polyamides: Also known as aramids, this category is preferred by many Xometry users to create fibers such as Nomex (used in fire-resistant fabrics), and Kevlar (known for its use in the construction of bullet-resistant vests).

-

Semi-Aromatic Polyamides: These high-performance engineering polymers, also known as polyphthalamides or PPA, have impressive high-temperature properties. Some of these include Rislan or Zytel.

The molecular structure of polyamides can vary greatly, i.e., aliphatic polyamides like Nylon are polymerized from monomers like caprolactam and hexamethylenediamine. Aromatic polyamides, on the other hand, are polymerized from para-phenylenediamine and terephthaloyl chloride.

Polyamides possess high tensile strength. Their name alone refers to a range of different materials, some of which can be woven into fibers, cast, or injection molded. Nylon 6, for example, is an aliphatic polyamide that has a tensile strength of about 40MPa. Kevlar 29 is an aromatic polyamide that has a tensile strength of 3600 MPa. This considerable difference is because of the huge range of materials in the polyamide group.

Polyamide Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 46.59 billion |

| Revenue forecast in 2034 | USD 76.24 billion |

| Growth rate | CAGR of 6.35% from 2025 to 2034 |

| Historical data | 2019 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | Product, application, region |

| States scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Key companies profiled | BASF; Evonik AG; Arkema; Solvay; Domo Chemicals; DSM-Firmenich; Lanxess; DuPont; TORAY INDUSTRIES, INC.; Ascend Performance Materials; Koch IP Holdings, LLC.; Advansix; Celanese Corporation; Huntsman International LLC; Mitsui Chemicals |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What Is Polyamide Material?

Polyamides are divided into three categories: aliphatic, aromatic, and semi-aromatic polyamides. Polyamides can be woven into fibers, cast, or injection molded. Polyamides tend to have poor resistance to moisture absorption but have excellent tensile strength and impact resistance depending on the grade.

The molecular structure of polyamides varies widely. Aliphatic polyamides (Nylon) are polymerized from monomers such as caprolactam and hexamethylenediamine and aromatic polyamides are polymerized from para-phenylenediamine and Ter phthaloyl chloride.

How Strong Are Polyamide Materials?

The term “polyamide” refers to a wide range of different materials. A good measure of this is tensile strength. Nylon 6, an aliphatic polyamide, has a tensile strength of approximately 40 MPa. Kevlar 29, an aromatic polyamide, has a tensile strength of 3600 MPa. This large difference in properties is a testament to the large range of materials in the polyamide group.

What Are Polyamides Used For?

Depending on the subcategory of materials, each polyamide will have different uses and applications. Here are some examples:

- Kevlar: This is a popular material that is often woven into bullet-resistant vests and used to reinforce tires.

- Nomex: Due to its outstanding thermal resistance properties, Nomex is a go-to material for workwear and fire-resistant suits.

- Nylon: An extremely popular and equally versatile material, Nylon can be spun into a fiber and injection molded. Some examples of where Nylon might be used include gear wheels and rope. It is also one of the most commonly 3D printed materials at Xometry via our SLS and MJF processes which primarily utilize Nylon materials.

- Wool: Another favorite, wool is used in the production of clothing, furniture, carpets, and other household goods.

Here Are Some Of The Top Products In The Polyamide Market

-

Polyamide 6 (PA6 / Nylon 6)

•Widely used in automotive, textiles, packaging

• Known for wear resistance and elasticity -

Polyamide 66 (PA66 / Nylon 6,6)

•Used in engine parts, electrical connectors

•High heat resistance and mechanical strength -

Bio-Based Polyamides (PA11, PA12)

•Sustainable, from renewable resources

•Used in automotive, medical, electronics -

Polyphthalamide (PPA)

•High-performance for automotive and electrical parts

•Excellent thermal and chemical stability -

Polyamide 46 (PA46)

•Used in automotive under-hood, electrical connectors

•High melting point and dimensional stability -

Polyamide 12 (PA12)

•Flexible tubing, fuel lines, 3D printing

•Low moisture absorption, chemical resistance -

Biaxially Oriented Polyamide (BOPA) Films

•Food packaging, flexible films

•High strength and oxygen barrier properties -

Polyamide Fibers

•Textiles, carpets, ropes, airbags

•Durable with high tensile strength -

Thermoplastic Polyamides

•Automotive parts, sporting goods, medical devices

•Good processability and recyclability -

High-Performance Polyamides (e.g., PARA, PPA)

•Aerospace, medical, industrial uses

•Exceptional thermal and mechanical properties

What Are The Major Trends In The Polyamide Market?

- There’s growing preference for bio-based polyamides, driven by sustainability concerns and the need to reduce reliance on fossil fuels. These materials are gaining traction in various applications, including automotive and textiles, due to their environmental benefits.

- The industry is witnessing significant advancements in recycling technologies, particularly chemical recycling methods. These innovations are enhancing the sustainability of polyamide production by enabling the reuse of materials and recycling waste.

- Polyamides are increasingly being integrated into electric vehicle components, owing to their lightweight and durable properties. This trend is contributing to the development of more efficient and sustainable electric vehicles.

- There’s a notable expansion in the use of specialty polyamides in high performance applications, such as 5G electronics and additive manufacturing. These materials offer enhanced properties that meet the demanding requirements of advanced technologies.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5637

Polyamide Market Dynamics

Can AI Drive Smarter Polyamide Design?

Advances in machine learning and generative AI are enabling researchers to virtually simulate and predict polymer behaviour. Accelerating the discovery of novel polyamide chemistries with optimized thermal, mechanical or recycling traits before physical testing.

Will Sustainable Demand Better Raw Materials?

The mounting pressure on industries to reduce carbon footprints is pushing developers to adopt bio-based and low carbon polyamides derived from renewable feedstock, which appeal to greener value chains and regulatory frameworks.

Market Opportunity

Can Closed Loop Recycling Open New Revenue Streams?

The ability o upcycle waste polyamide into high performance materials using catalyst free, solvent free processes offer manufacturers a pathway to circular business models and lower reliance on virgin feedstock, which can improve margins and sustainability credentials.

Will recycled Composites Enter Advanced Industries?

The integration of recycled polyamide from sources like fishing nets and carbon fibre waste into composite materials presents an opportunity to meet demand in sectors like aerospace, automotive, and sports equipment for lighter yet durable materials.

Limitations In The Polyamide Market

- High production costs restrict market expansion. The synthesis of polyamide requires complex, multi-step chemical processes, expensive raw monomers, specialized equipment, and stringent purification steps, all of which drive up manufacturing expenses.

- Supply chain and regulation pressures pose challenges. Volatility in raw material supply, transportation delays, and stricter environmental regulations increase risk and uncertainty for producers in maintaining consistent output and price stability.

Polyamide Market Segmentation Insights

Product Type Insights

Why Is Polyamide 6 Dominating In Polyamide market?

The polyamide 6 segment dominated the market in 2024, and this dominance is tied to its tied to its versatile properties that make it suitable across diverse industries. Polyamide 6 offer excellent mechanical strength, durability, and resistance to wear, which has made it a preferred choice in sectors such as automotive, textiles, and packaging. Its adaptability in replacing heavier materials with lightener yet robust alternatives further supports its wide adoption. The ability of polyamide 6 of balance performance with cost efficiency enhances its relevance in large scale applications. Together, these attributes have allowed polyamide 6 to remain central to the market and strengthen its position in global demand.

The bio-based polyamide segment is projected to experience the highest growth rate in the market between 2025 and 2034. As sustainability becomes an increasingly important driver of industrial innovation. Bio-based polyamides, derived from renewable resources, are gaining attention for their lower environmental footprint compared to traditional petroleum based variants. Industries such as automotive, textiles, and consumer goods are adopting bio-based variants.

Application Insights

Why Is Engineering Plastics Dominating Polyamide Market?

The engineering plastics segment dominated the market In 2024, driven by the rising need for high performance materials across critical sectors. Engineering plastics made from polyamides are valued for their ability to withstand head, mechanical stress, and chemical exposure, making them essential in automotive components, electrical devices, and industrial machinery. These materials not only replace metals but also improve efficiency, safety, and performance across applications. With industries striving for lighter yet stringer materials, engineering plastics have consistently found new areas of adoption. This versatility and performance advantage ensure the segment maintains a dominant role in shaping the polyamide market.

The fibers segment is projected to expand rapidly in the market in the coming years, supported by strong demand in textiles, carpets, and industrial fabrics. Polyamide fibres are prized for their strength, elasticity, and resistance to abrasion, making them suitable for both fashion and functional purposes. The rising popularity of sportswear, active wear, and performance apparel is a key factor boosting fibers demand, while industrial uses such as ropes and nets further enhance its growth potential.

Regional Insights

Which Region Drives The Polyamide Market Growth In Asia Pacific?

The Asia Pacific polyamide market is expected to increase from USD 21.11 billion in 2025 to USD 32.65 billion by 2034, growing at a CAGR of 4.96% throughout the forecast period from 2025 to 2034. Asia Pacific dominates the global polyamide market in 2024 on the back to its vast industries base, expanding automotive manufacturing, and strong electronics and textiles sector. Major countries in the region leverage cost-competitive raw material supply and large scale infrastructure o boost production. Moreover, increasing adoption of bio-based polyamides and growing demand for lightweight, high-performance plastics in automotive and industrial applications help consolidate Asia Pacific’s position. Regulatory improvements and investments in sustainable materials also support the region’s expansion.

China is central to Asia Pacific’s dominance, driven by its large scale manufacturing hubs in automotive, electronics, and textiles. Its strong export capability reinforces its position, supplying polyimides across regional markets for use in complemented by favourable raw material availability and the need for high performance engineering plastics further supports China’s leading role in the market.

India is witnessing rapid growth in the polyamide market, supported by expanding production in textiles such as athletic wear, fabrics, and other appeal that drive strong demand for polyamides. The automotive sectors is also playing avital role, with rising adoption of lightweight materials boosting market expansion. Key manufacturing hubs located in states like Tamil Nadu, Maharashtra, and Gujrat further strengthen domestic supply capabilities. Additionally, increasing demand for appliances and consumer goods, along with the rising penetration of consumer electronics, is addicting momentum to the market’s growth trajectory.

Why Is North America The Fastest Growing Region In The Polyamide Market?

North America expects the fastest growth in the polyamide market during the forecast period, driven by several key factors. The expansion of automotive industry, particularly the increasing demand for lightweight and fuel efficient vehicles, has significantly boosted the consumption of polyamides. Additionally, the growing packaging industry and the rising demand for consumer electronics and appliances have further contributed to the market’s growth. The region’s strong emphasis on technological advancements and innovation has also played a crucial role in accelerating the adoption of polyamides across various sectors.

Among the countries in North America, the united States stands out as the dominant player in the market. The country’s robust industrial base, coupled with significant investments in research and development, has propelled its leadership in polyamide production and consumption.

Europe Polyamide Market Trends

The polyamide market in Europe is driven by several key factors that interconnect with its industrial strengths and regulatory environment. The region's robust automotive and aerospace sectors are primary drivers, with manufacturers such as Volkswagen, BMW, and Airbus increasingly using polyamides to reduce vehicle weight and improve fuel efficiency. Moreover, the region's stringent environmental regulations, particularly the EU's push toward sustainable materials and circular economy initiatives, have spurred innovation in bio-based and recycled polyamides.

Polyamide market in Germany is primarily driven by its strong chemical industry infrastructure, anchored by companies such as BASF, Lanxess, and Evonik AG, whichprovides a competitive advantage in polyamide production. These companies have established extensive R&D facilities and production plants across Germany, enabling them to develop specialized grades of polyamides for specific applications. For instance, BASF's Ultramid product line includes various polyamide formulations optimized for different industrial uses, from automotive parts to consumer goods.

More Insights in Towards Chemical and Materials:

- Polymers Market : The global polymers market size was reached at USD 796.53 billion in 2024 and is expected to be worth around USD 1,351.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.43% over the forecast period 2025 to 2034.

- Polymer Foam Market : The global polymer foam market size was approximately USD 160.43 billion in 2025 and is projected to reach around USD 273.58 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 6.11% between 2025 and 2034.

- Polypropylene Compounds Market : The global polypropylene compounds market size was approximately USD 23.89 billion in 2024 and is projected to reach around USD 50.86 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 7.85% between 2025 and 2034.

- Bio-Based Polymers Market : The global bio-based polymers market size was reached at USD 12.08 billion in 2024 and is expected to be worth around USD 58.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.06% over the forecast period 2025 to 2034.

- Recycled Polystyrene Market : The global recycled polystyrene market size was reached at USD 4.95 billion in 2024 and is expected to be worth around USD 7.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.23% over the forecast period 2025 to 2034.

- Bio-Based Polyurethane Market : The global bio-based polyurethane market size was reached at 4.86 million tons in 2024 and is expected to be worth around 10.73 million tons by 2034, growing at a compound annual growth rate (CAGR) of 8.24% over the forecast period 2025 to 2034.

- Biopolymers Market : The global biopolymers market size was valued at USD 19.85 billion in 2024, grew to USD 21.93 billion in 2025, and is expected to hit around USD 53.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.46% over the forecast period from 2025 to 2034.

- Polypropylene Market : The global polypropylene market volume was reached at 87.21 million tons in 2024 and is expected to be worth around 135.05 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.47% over the forecast period 2025 to 2034.

- Polyvinylpyrrolidone (PVP) Market : The global polyvinylpyrrolidone (PVP) market size was valued at USD 3.19 billion in 2024, grew to USD 3.40 billion in 2025, and is expected to hit around USD 6.07 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period from 2025 to 2034.

- Polyolefin Compounds Market : The global polyolefin compounds market size was reached at USD 27.19 billion in 2024 and is expected to be worth around USD 42.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.65% over the forecast period 2025 to 2034.

- Polyester Hot Melt Adhesives (PHMAs) Market : The global polyester hot melt adhesives (PHMAs) market size was reached at USD 505.05 million in 2024 and is expected to be worth around USD 1,491.92 million by 2034, growing at a compound annual growth rate (CAGR) of 11.44% over the forecast period 2025 to 2034.

- Polymer Chameleon Market : The global polymer chameleon market size was reached at 453.18 million in 2024 and is expected to be worth around USD 1,225.52 million by 2034, growing at a compound annual growth rate (CAGR) of 10.46% over the forecast period 2025 to 2034.

- Extruded Polystyrene Market : The global extruded polystyrene market size was reached at USD 7.19 billion in 2024 and is expected to be worth around USD 12.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% over the forecast period 2025 to 2034.

- Polyvinyl Butyral (PVB) Market : The global polyvinyl butyral (PVB) market size was reached at USD 3.89 billion in 2024 and is expected to be worth around USD 7.41 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period 2025 to 2034.

- Bio-Polyamide Market : The global bio-polyamide market size was valued at USD 258.19 million in 2024. The market is projected to grow from USD 311.25 million in 2025 to USD 1673.45 million by 2034, exhibiting a CAGR of 20.55% during the forecast period.

- Bio-Based Polypropylene Market : The global bio-based polypropylene market stands at 49.18 kilo tons in 2025 and is forecast to reach 261.27 kilo tons by 2034, advancing at a 20.39% CAGR.

- Green Polypropylene Market : The global green polypropylene market size was valued at USD 22.85 billion in 2024 and is expected to hit around USD 72.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.27% over the forecast period from 2025 to 2034.

- Renewable Polypropylene Market : The global renewable polypropylene market size was valued at USD 58.85 billion in 2024 and is expected to hit around USD 133.67 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.55% over the forecast period from 2025 to 2034.

- Asia Pacific Polymers Market : The Asia Pacific polymers market size was reached at USD 348.97 Billion in 2024 and is expected to be worth around USD 598.92 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.55% over the forecast period 2025 to 2034.

- Europe Polymer Market : The Europe polymer market size was approximately USD 385.31 billion in 2024 and is projected to reach around USD 642.73 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 5.25% between 2025 and 2034.

- U.S. Polymer Foam Market : The U.S. polymer foam market size was reached at USD 14.49 billion in 2024, grew to USD 15.17 billion in 2025 and is expected to be worth around USD 22.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.65% over the forecast period 2025 to 2034.

- U.S. Polypropylene Market : The U.S. polypropylene market size was valued at USD 19.70 billion in 2024, grew to USD 20.49 billion in 2025 and is expected to hit around USD 29.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.98% over the forecast period from 2025 to 2034.

Polyamide Market Top Key Companies:

- BASF (Germany)

- Envalior (Germany)

- Celanese Corporation (US)

- Arkema (France)

- Evonik Industries AG (Germany)

- Asahi Kasei Corporation (Japan)

- KURARAY CO., LTD. (Japan)

- TORAY INDUSTRIES, INC. (Japan)

- UBE Corporation (Japan)

- FCFC (Taiwan)

- Ascend Performance Materials (US)

- Mitsubishi Chemical Group (Japan)

- INVISTA (US)

- LEALEA ENTERPRISE CO., LTD. (Taiwan)

- Huntsman International LLC (US)

Polyamide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Polyamide Market

By Product Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2034)

- Polyamide 6

- Polyamide 66

- Bio-based Polyamide

- Specialty Polyamides

By Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2034)

- Engineering Plastics

- Automotive

- Electrical & Electronics

- Consumer Goods & Appliances

- Packaging

- Others

- Fibers

- Textile

- Carpet

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5637

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.